Successful people, organizations, and governments know that the first step in analyzing and solving a complex predicament is to articulate the Problem and the Objective accurately.

PROBLEM

The current status of U.S. federal fiscal affairs and the processes that abetted it are in dangerous disarray and require prompt and enduring reform.

OBJECTIVE

Analyze all relevant aspects of the U.S. federal deficits and growing debt, produce a balanced and fair plan that will put our country on a responsible fiscal path forward, and execute this plan into law and one or more constitutional amendments in ways that will endure future temptations to weaken or destroy it.

STATUS OF U.S. FISCAL AFFAIRS

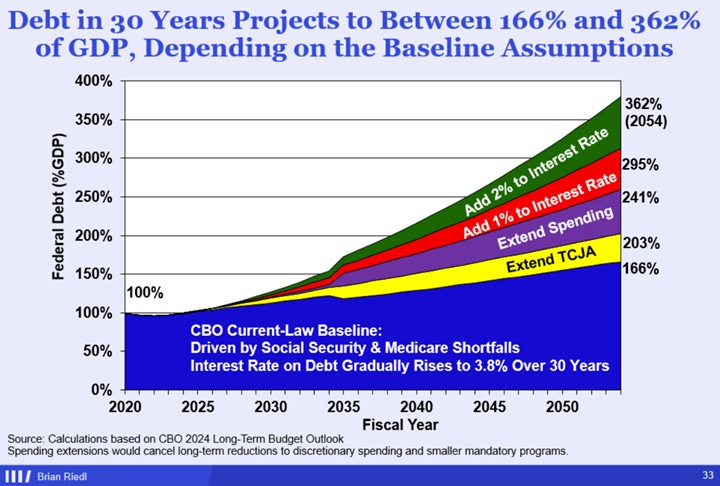

The 2025 Debt Held by the Public is almost 100% of GDP, a dangerous level demonstrated by the recent Moody’s credit rating downgrade, weakness in the dollar, and challenges in the Treasury Bond markets. Even worse, the Congressional Budget Office (CBO) and independent think tanks and academics predict that federal debt levels will rise faster in coming years and decades.

Federal spending for 2025 will be about $7.0 trillion with around $5.1 trillion in revenue, leaving another huge deficit of $1.9 trillion added to the federal debt.

Very relevant to the task of solving the federal fiscal predicament is the evidence that many if not over half of the members of Congress still have not accepted that it is their most dangerous problem, underlying every program in the budget. The daily news is replete with examples of higher spending and cutting revenues (taxes, etc.) being of primary importance to politicians, the opposite of fiscal sanity. Surprise? No, but fiscal insanity is rapidly weakening our country.

Brian Riedl, Manhattan Institute

When you find yourself in a hole, stop digging!

MISSING! AN ALL-INCLUSIVE PLAN

An all-inclusive plan must consider and balance the interactions of all its components to accomplish the objective above. Would a team designing a new aircraft switch to another manufacturer’s heavier engines without making thoughtful adjustments elsewhere? Should a team developing a plan to put our country on a responsible fiscal path forward just decide to make all the decisions regarding Medicare before understanding the role those decisions play on all the other moving parts (social security, taxes, defense, welfare programs, effect on those least able to help themselves, need to sustain a growing economy (GDP), public acceptance, schedule of implementation over the coming years, and much more)?

An all-inclusive plan must also phase in the implementation of all changes over coming years to balance the need for gaining control over the federal debt with public acceptance.

What an all-inclusive plan is not is “The One Big Beautiful Bill” being debated now in Congress or the previous administration’s misnamed “Inflation Reduction Act”. It is not per Nancy Pelosi’s "We have to pass the bill," she said, "so that you can find out what is in it — away from the fog of the controversy." It is not a plan without a stated problem and objective. It is one carefully crafted by experts, concentrating on the task in front of them.

Due to its nature, the plan must be large and complex and implemented as a package; there will be more detail on how to do this in my subsequent articles. Its development must be transparent and carefully explained to the public as it progresses.

PLAN’S NECESSARY INGREDIENTS

Everything must be on the table from the beginning, meaning all elements of federal income and spending and other relevant issues.

The resulting plan must provide assurance that it will endure, providing sound fiscal management that will continue indefinitely.

SUSTAINABLE FISCAL DISCIPLINE – COMING ARTICLES

On the theme of the Federal Debt, we covered in this article and the previous one:

Comprehending the Severity

WHAT must be done

The three forthcoming articles on Federal Debt will be:

WHO must produce the Plan and make it work?

HOW can this happen?

WHEN is it needed, and a Summary?

Albert Einstein

“Insanity is doing the same thing over and over again

and expecting a different result.”